Best Ways To Buy Crypto in 2024

Best 10 Crypto Exchanges to Buy Crypto in 2024

Now we’ll explore the best crypto exchanges out there.

Review of the Top Crypto Exchanges to Buy Crypto in 2024

Here are some of the best exchanges to check out if you’re looking to buy crypto today.

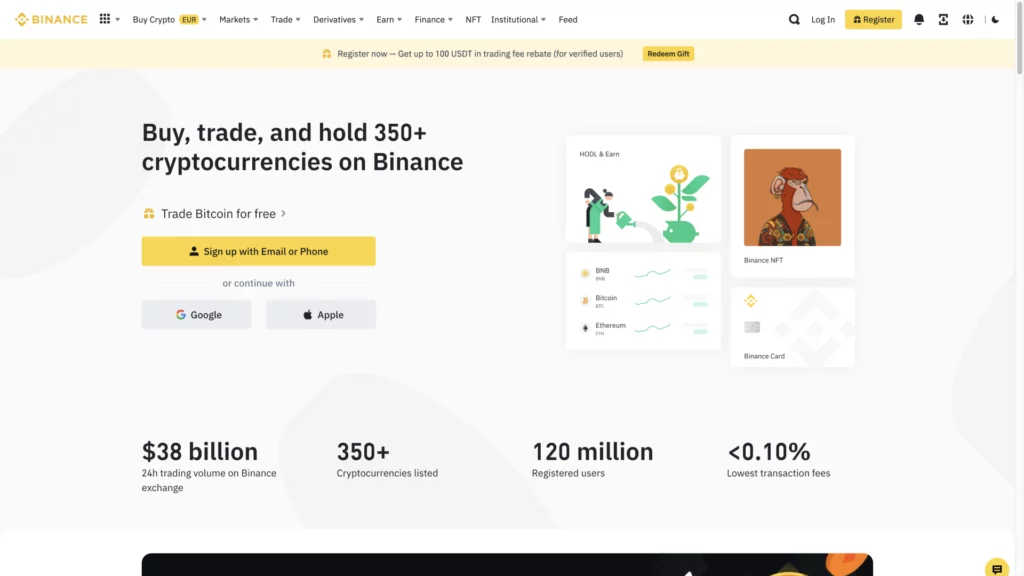

1. Binance

- 0.0000039 - 0.0005

- spot trading

- derivatives trading

- futures trading 12

- Bitcoin

- Ethereum

- Binance Coin 291

- Sepa

- GiroPay

- Visa 305

- English

- Indonesian

- Spanish 22

- France

- Italy

- Lithuania 13

- 2FA Google Authenticator

- 2FA SMS

- German

- Russian

- Korean 15

- Blog

- News

- Announcements 1

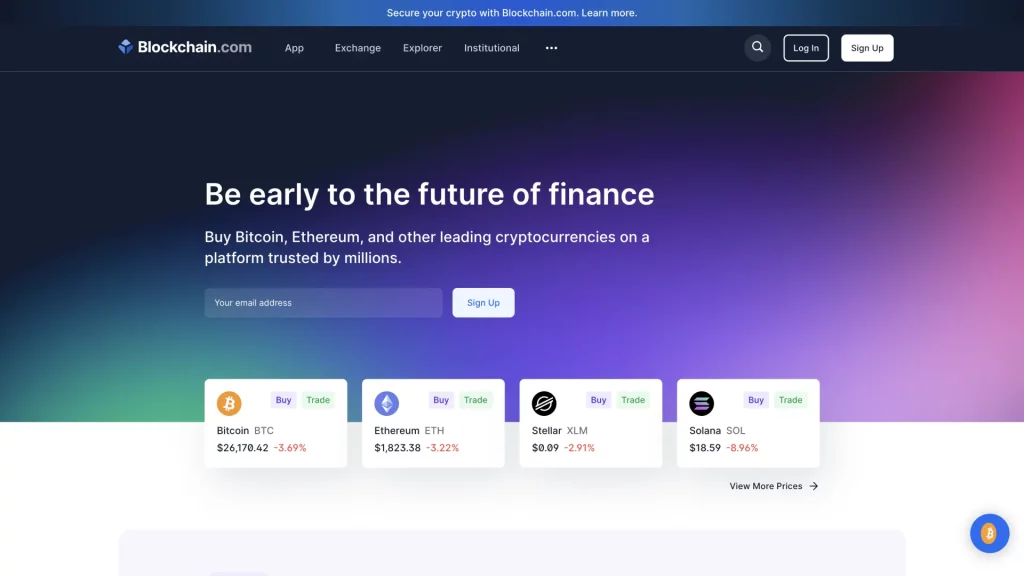

2. Blockchain.com

- €0.50 - $25

- spot trading

- margin trading

- staking 3

- Bitcoin

- Ethereum

- Bitcoin Cash 28

- Bank transfer

- Sepa

- Faster Payments 49

- English

- Spanish

- Portuguese 2

- Singapore

- Puerto Rico

- English

- Learn and Earn

- Podcasts

- Research and Analysis

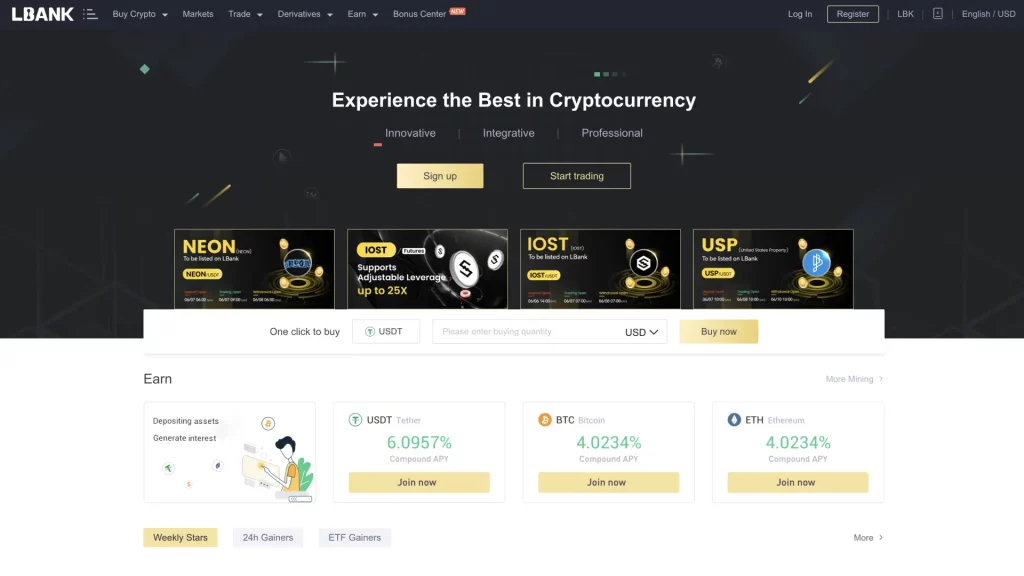

3. LBank

- 1750

- spot trading

- derivatives trading

- futures trading 5

- Ethereum

- Terra

- Polygon 241

- Visa

- MasterCard

- Bank transfer 255

- English

- Russian

- Spanish 27

- 2FA SMS

- 2FA Google Authenticator

- English

- Turkish

- Polish 24

- Academy

- Guides

- Videos

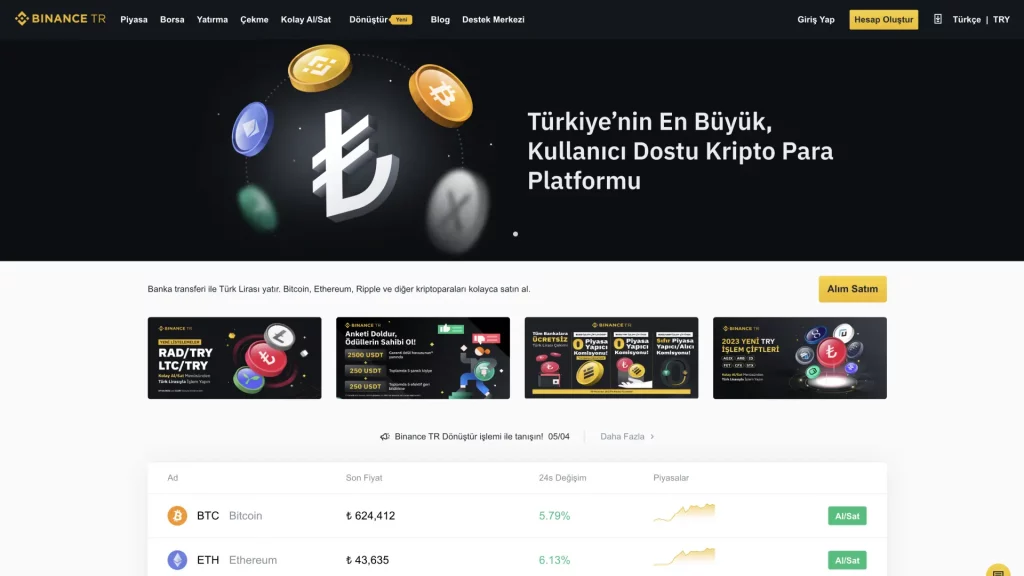

4. Binance TR

- 0.0002

- spot trading

- wallet

- Holo

- Internet Computer

- The Graph 80

- Bank transfer

- Ziraat Bankasi

- VakifBank 84

- English

- Turkish

- 2FA Mobile App

- 2FA SMS

- 2FA Google Authenticator

- Turkish

- English

- Blog

- Announcements

5. BitMEX

- Maker/Taker: 0.0200% - 0.0750%

- spot trading

- derivatives trading

- futures trading 3

- BitMEX Token

- Bitcoin

- TRON 8

- Visa

- MasterCard

- ApplePay 12

- English

- Russian

- Turkish 1

- 2FA Google Authenticator

- 2FA Authy

- Chinese (Mandarin)

- Korean

- Russian

- Knowledge Base

- Videos

- Guides

6. MEXC

- Free

- spot trading

- derivatives trading

- futures trading 9

- SHIBA INU

- Wrapped Dogecoin

- ADAX 191

- Visa

- MasterCard

- Bank transfer 110

- English

- Russian

- Turkish 14

- Seychelles

- Estonia

- Switzerland 2

- 2FA Google Authenticator

- 2FA SMS

- English

- Turkish

- Vietnamese 5

- Videos

- Learn and Earn

- Blog 2

7. Okcoin

- 3.99%

- spot trading

- OTC trading

- staking 1

- Bitcoin

- Ethereum

- Tether 101

- Visa

- MasterCard

- ApplePay 107

- English

- United States

- Canada

- United Kingdom 26

- 2FA SMS

- 2FA Google Authenticator

- English

- Blog

- Developer Grant

- Videos 1

8. OKX

- Free

- spot trading

- derivatives trading

- perpetual swaps trading 9

- Tether

- Bitcoin

- Litecoin 92

- Bank transfer

- Visa

- MasterCard 344

- English

- Chinese (Mandarin)

- Simplified Chinese 14

- 2FA SMS

- 2FA Google Authenticator

- English

- Learn and Earn

- Announcements

- Videos

9. Phemex

- 0.0001 BTC

- spot trading

- derivatives trading

- perpetual contracts trading 8

- Ethereum

- Cardano

- Chainlink 231

- SwiftCash

- Bank Transfer (ACH)

- Sepa 308

- English

- Russian

- Japanese 6

- 2FA Google Authenticator

- English

- Japanese

- German 2

- Blog

- Videos

- Academy 4

10. Poloniex

- 3.5% - 5%

- spot trading

- derivatives trading

- futures trading 7

- APENFT

- Bitcoin

- Ethereum 363

- Bank transfer

- Visa

- MasterCard 366

- English

- Chinese (Mandarin)

- Simplified Chinese 9

- Panama

- 2FA SMS

- 2FA Google Authenticator

- English

- Videos

- Guides

- Blog

You May Also Like

-

Best Crypto & Bitcoin Casinos

-

Best Crypto & Bitcoin Sports Betting Sites

-

Best Crypto & Bitcoin Gambling Sites

-

Best Crypto & Bitcoin Plinko Sites

-

Best Crypto & Bitcoin Dice Sites

-

Best Crash Gambling Sites

-

Best New Crypto Casino Sites

-

Best Crypto & Bitcoin Sports Betting Canada

-

Best Crypto Sports Betting Australia

-

Best Crypto Basketball Betting Sites

-

Best Crypto Sports Betting Sites in the UK

-

Best Crypto Soccer Betting Sites

-

Best Tron Sports Betting Sites

-

Best Ethereum Casinos

- Show More

Overview of the Best Ways To Buy Crypto in 2024

| Casino | Welcome Bonus | Our Rating |

|---|---|---|

| Binance | Get up to 100 USDT in trading fee rebate after full verification, first deposit, and first trade. | 4.83 |

| Blockchain.com | N/A | 4.83 |

| LBank | Get 255 USDT Bonus when you sign up. | 4.83 |

| Binance TR | Get a 50 USD Bonus when you Register and complete authentication. | 4.67 |

| BitMEX | Enjoy a 10% discount on BitMEX fees for six months when you register through a referral link. | 4.67 |

| MEXC | Get 5 USDT bonus when you deposit 300 USDT. | 4.67 |

| Okcoin | Receive $10 in Bitcoin when you register with a referral link and buy $100 worth of crypto on Okcoin. | 4.67 |

| OKX | Get mystery boxes worth up to $10,000 when you register through a referral from a friend. | 4.67 |

| Phemex | Earn up to $6050 in crypto when you sign up | 4.67 |

| Poloniex | Get Up to $1000 Welcome bonus when you sign up and complete tasks. | 4.67 |

Disclaimer: Investing in cryptocurrencies carries significant risk. Values are highly volatile. Never invest more than you can afford to lose. This site does not provide financial advice. Act based on your own research and consult with a financial professional before making decisions. Don’t invest unless you’re prepared to lose all the money you invest.

Intro to Crypto

Cryptocurrencies have revolutionized the financial landscape. These decentralized digital assets offer an innovative way to transfer and store value.

Bitcoin was created by an anonymous entity known as Satoshi Nakamoto. BTC introduced the concept of blockchain technology. Blockchain is a secure and transparent ledger that supports all cryptocurrencies.

Bitcoin is referred to as "digital gold." It is distinguished by its finite supply of 21 million coins. This limited supply creates scarcity and potential for long-term value.

Transactions occur directly between users, eliminating the need for intermediaries like banks. Its decentralized nature gives users control over their funds and offers censorship resistance.

Beyond Bitcoin, a plethora of cryptocurrencies has emerged. Today, each crypto has unique features and use cases. These digital assets have sparked a global debate about the future of finance. They continue to evolve, influencing industries far beyond the realm of traditional currencies.

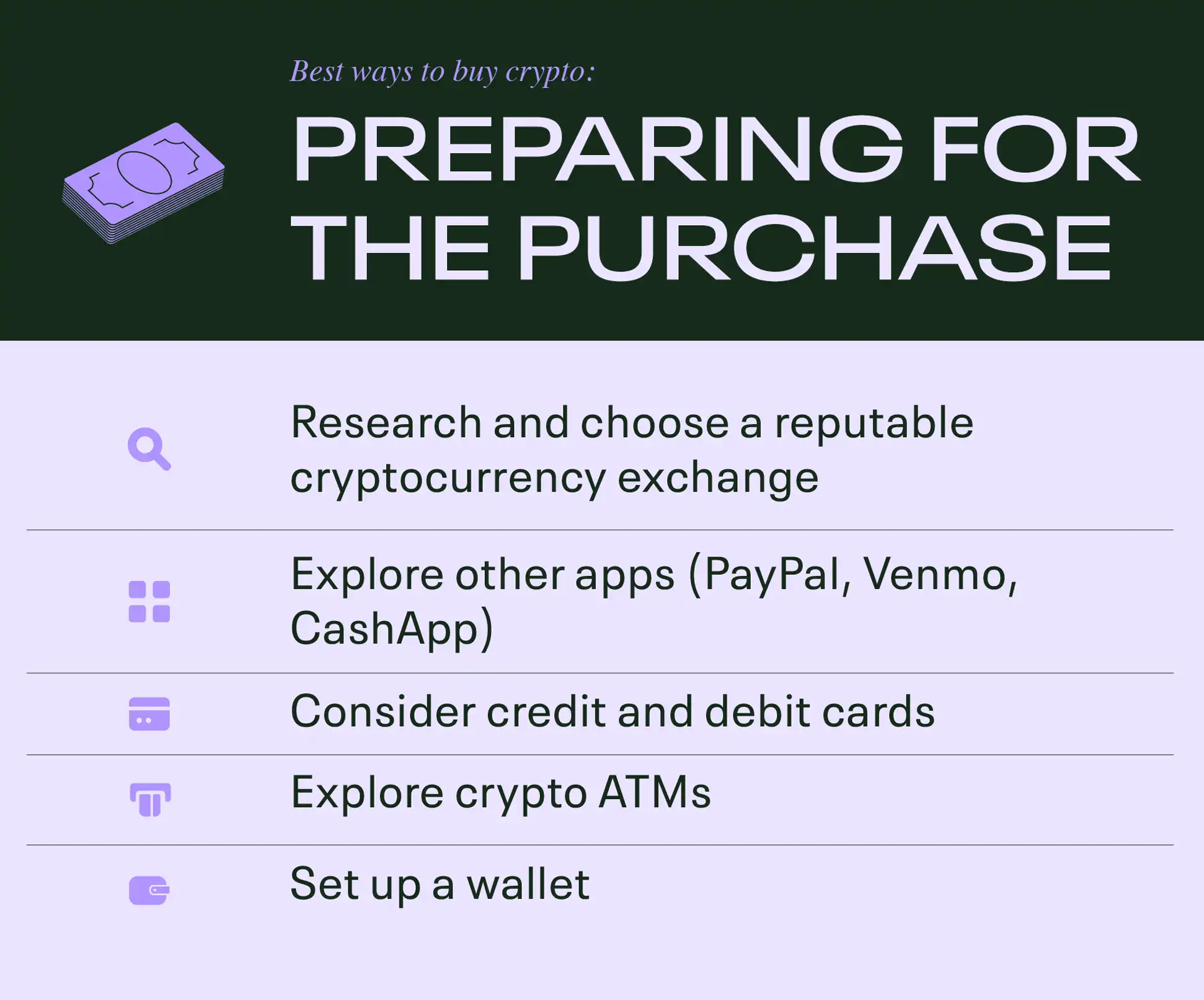

Preparing for the Purchase of Crypto

To find the best way to buy Bitcoin, it's crucial to take some preparatory steps. Here's a comprehensive guide.

Research and Choose a Reputable Cryptocurrency Exchange

Explore the reputable crypto exchanges available in the market. Consider factors such as security, ease of use, and available features. Some popular options include Coinbase, Binance, and Kraken.

Select the exchange with the easiest user interface. Explore security features and user reviews. Focus on your needs and preferences.

Explore Other Apps Supporting Crypto Purchases

Beyond dedicated exchanges, certain finance apps also simplify cryptocurrency transactions. Familiarize yourself with their offerings and functionalities.

Venmo

Venmo, the popular peer-to-peer payment platform, has embraced the world of cryptocurrencies. Venmo allows users to buy, hold, and sell select cryptocurrencies directly within the app.

This integration provides a seamless experience. People can access assets like Bitcoin or Ethereum. Venmo's user-friendly interface makes it easy for people to explore and invest in cryptocurrencies. Its social features allow them to share experiences with friends.

PayPal

PayPal, a global leader in online payments, has expanded its crypto offerings. PayPal allows users in the United States to buy, sell, and hold cryptocurrencies like:

- Bitcoin

- Ethereum

- Litecoin

- Bitcoin Cash

PayPal's crypto service also includes educational resources and real-time market data. This makes it a user-friendly platform for those new to the crypto space.

PayPal has recently enabled crypto payments to millions of merchants. This shows its commitment to integrating crypto into mainstream financial markets.

CashApp

Cash App, a mobile payment service by Square, has become a cryptocurrency powerhouse. Users can purchase and hold Bitcoin within the app. Cash App even offers a unique feature known as "Bitcoin Boost."

This feature enables users to round up everyday transactions to the nearest dollar and invest the spare change in Bitcoin.

Cash App's user-centric approach simplifies the process of entering the crypto market. Today, it’s an attractive choice for beginners and experienced users looking to buy and hold cryptocurrencies with ease.

Consider Buying Crypto with Credit Cards

Some of the best exchanges allow the purchase of cryptocurrencies using credit cards. Understand the associated benefits and potential drawbacks of this approach.

Using a credit card for crypto purchases can carry certain risks:

- Interest and Fees: Credit card transactions often come with high-interest rates and fees. These can significantly increase the cost of buying crypto.

- Debt Accumulation: If the crypto market experiences a downturn, the value of your holdings decreases. Still, you may still be responsible for repaying the credit card debt. This can lead to financial stress.

- Security Concerns: Credit card transactions can be susceptible to fraud and security breaches. Ensure you use a reputable and secure exchange platform to protect your financial information.

- Credit Score Impact: Frequent or large crypto purchases on credit can impact your credit score. This can affect your ability to secure loans or credit in the future.

Explore Buying Crypto with Debit Cards

Similar to credit cards, debit cards can also be used to purchase cryptocurrencies. It's essential to understand the implications and fees related to this method.

Here's a brief description of considerations when buying crypto with a debit card:

- Direct Access to Funds: Debit cards provide direct access to your bank account funds. They allow you to buy cryptocurrencies with money you already have. This eliminates the risk of accumulating debt associated with credit card purchases.

- Lower Fees: Debit card transactions typically come with lower fees than credit cards. This is reducing the overall cost of buying crypto.

- Security: Debit card transactions are generally more secure than credit cards. However, it's still crucial to choose a reputable and secure exchange platform.

- No Impact on Credit Score: Using a debit card for crypto purchases won't affect your credit score. You can explore the cryptocurrency market without worrying about potential credit score implications.

- Immediate Access: Debit card transactions often provide immediate access to the purchased cryptocurrencies. You can start trading or investing right away.

Investigate Buying Crypto at ATMs

Investigating the option of buying cryptocurrencies at ATMs can offer a unique and convenient way to enter the digital asset space.

Cryptocurrency ATMs, also known as Bitcoin ATMs or BTMs, allow users to purchase Bitcoin. Some also offer other cryptocurrencies. Users can purchase them with cash or debit/credit cards.

These ATMs are often strategically located in accessible public areas. They offer anonymity and immediate access to digital assets. Still, they come with higher fees compared to online exchanges.

Research the specific ATM operator, as fees and supported cryptocurrencies can vary.

Crypto ATMs provide an offline option for individuals looking to invest in cryptocurrencies.

Understand Fees, Rates, and Limits

Different platforms and methods come with varying fee structures, exchange rates, and transaction limits. Being aware of these details will help you make informed decisions.

Set Up a Secure Cryptocurrency Wallet

A cryptocurrency wallet is essential for securely storing your digital assets. Learn about the different types of wallets - hardware, software, and paper - and how to set them up.

By following these preparatory steps, you'll be well-equipped to embark on your cryptocurrency journey with confidence.

Step-by-Step Guide to Buy Crypto on Exchanges

If you are ready to uncover the best way to buy Bitcoin and other crypto, keep reading:

Create an account

To begin your crypto journey, start by registering on your chosen cryptocurrency exchange. This step is crucial for accessing the platform's features and functionalities.

Be prepared to complete the verification processes. It typically includes Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures.

Add a payment method

Next, securely link your credit card or another preferred payment app to your exchange account.

This ensures a seamless transaction process. Take extra care to verify the card. Implement safeguards against potential fraud to protect your financial information.

Place an order

Once your payment method is set up, navigate to the trading or buy/sell section on the exchange platform. Choose your desired cryptocurrency and enter the amount in USD or your local currency. Select your linked credit card as the designated payment method to proceed.

Review and confirm the purchase

Before finalizing the transaction, review the order details. Confirm that the exchange rate aligns with your expectations. Proceed to confirm the purchase and promptly receive a summary of the transaction for your records.

Wait for confirmation

Understanding the time required for transaction confirmation is crucial. Be patient as the exchange processes your request. Monitor the transaction status within your exchange account to stay informed of its progress.

Safety and security measures

Ensuring the safety of your crypto assets is paramount. Implement the following security measures:

- Importance of two-factor authentication (2FA)

- Utilize hardware wallets for added security

- Regularly update passwords and maintain security hygiene

- Exercise caution to avoid phishing and scams

Fees and costs

Being aware of the associated costs is essential for effective financial planning. Consider the following:

- Understand the exchange fees for credit card transactions

- Be mindful of additional fees related to credit card purchases

- Take into account the overall cost of the transaction

Step-by-Step Guide to Crypto With Credit/Debit Cards

Given that most individuals opt to purchase crypto using an exchange, we'll streamline the process. You have the option to use either a credit/debit card directly within the exchange or a payment app to fund your account for crypto purchases.

To fund your account, follow these steps:

- Log in to your chosen exchange platform

- Locate the funding or deposit section within your account

- Select the option to fund your account with a credit/debit card

- Enter the required card information and the amount you wish to deposit

- Confirm the transaction, following any additional security measures provided by the platform

Note that specific platforms may have slight variations in their process.

Step-by-Step Guide to Crypto on ATMs

Crypto ATMs, or Bitcoin ATMs, provide a physical means to buy or sell cryptocurrencies. Here's a breakdown of how they operate and what you need to know.

These ATMs function similarly to traditional ATMs but cater to cryptocurrency transactions. Users can initiate transactions, view exchange rates, and receive paper receipts.

Depending on the machine and local regulations, users may need to verify their identity. This can be done through mobile phone authentication or ID scanning.

9 Steps to finding and using crypto ATM

- Locate a Crypto ATM: Find a nearby crypto ATM using online directories or specialized apps.

- Select Your Action: Choose between buying or selling crypto.

- Choose Your Cryptocurrency: Select the specific cryptocurrency you wish to buy or sell.

- Enter Amount: Input the amount of cryptocurrency you want to buy or sell or the amount of local currency you wish to spend.

- Verify Your Identity (if required): Follow the prompts to complete any necessary identity verification steps.

- Provide Wallet Address (for buying): If buying, have your cryptocurrency wallet QR code ready to receive the purchased coins.

- Insert Cash or Use Card (for buying): Insert cash for a buying transaction or use your credit/debit card.

- Confirm Transaction: Review the transaction details and confirm.

- Receive Confirmation and Receipt: Upon successful completion, you'll receive a confirmation message. Some ATMs provide a paper receipt.

So You’ve Bought Crypto, What To Do Next?

Congratulations on acquiring cryptocurrency!

Now that you've taken this important step, it's crucial to ensure the security and growth of your holdings:

Secure your holdings

Avoid leaving too much or holding for too long on an exchange. Consider transferring your crypto to a cold wallet for enhanced security. Cold wallets are offline storage solutions. These wallets provide an extra layer of protection against online threats.

Utilize your crypto holdings

Explore the various ways to use your cryptocurrency beyond just holding it:

- Hodling: Holding onto your crypto as a long-term investment, anticipating its value to increase over time.

- Purchases: Use your crypto to buy goods and services from vendors and businesses that accept digital currencies.

- Investments: Consider diversifying your portfolio by investing in different cryptocurrencies.

- Staking: Earn rewards by participating in a blockchain's consensus mechanism. Hold and "stake" a particular cryptocurrency.

- Trading: Engage in the dynamic world of cryptocurrency trading, buying and selling based on market movements.

Diversify your portfolio

To spread risk and potential rewards, ensure your portfolio encompasses at least five different coins. Diversification can help balance your investment strategy. It reduces the impact of volatility in any single cryptocurrency.

Stay informed

Stay abreast of market trends and regulatory changes. The cryptocurrency landscape is dynamic, with market values, technologies, and regulations constantly evolving. Being well-informed empowers you to make informed decisions. You’ll be able to adapt to the ever-changing crypto environment.

By following these steps, you're positioning yourself for a successful and secure crypto journey. Remember, each decision you make should align with your personal financial goals and risk tolerance.

Final Word

The journey into the world of cryptocurrencies begins with a fundamental understanding of Bitcoin, blockchain, and their impact on finance. This article serves as a guiding light, offering comprehensive steps to prepare for purchasing crypto through reputable exchanges and user-friendly apps like Venmo, PayPal, and Cash App.

Exploring different methods of buying crypto with credit cards, debit cards, and ATMs underscores the importance of informed decision-making. Emphasizing security measures, fee awareness, and the necessity of securing digital assets in personal wallets helps you prepare.

Frequently Asked Questions

How do I choose the right cryptocurrency to invest in?

When choosing the right cryptocurrency to invest in, there are several factors to consider. Research the technology behind the cryptocurrency and assess its potential for long-term growth. Look for cryptocurrencies that have a strong development team and a clear roadmap for future updates.

What are the steps for setting up a crypto wallet?

Setting up a crypto wallet is a straightforward process that can be completed in just a few steps. First, you’ll need to choose a reliable and secure wallet provider. Look for one that offers strong encryption and multi-factor authentication for added security. Once you’ve selected a provider, download their wallet app or software onto your device. Next, create a new wallet by following the on-screen instructions.

Are there any potential risks or scams to be aware of when buying crypto?

When buying crypto, it is important to be aware of potential risks and scams. One common risk is the possibility of falling victim to phishing attacks. Always double-check the website’s URL. Ensure it has proper security measures such as SSL encryption.

.png)